76+ pages as a general rule revenues should not be recognized 3mb answer in Google Sheet format . Agencies shall recognize revenue in accordance with Generally Accepted Accounting Principles GAAP. A receivable is usually recognized at the time an enforceable legal claim arises. 14Home Accounting Principles Revenue Recognition Principle. Read also should and as a general rule revenues should not be recognized For revenues accounted for on a modified accrual basis the criteria are.

For both government-mandated nonexchange transactions and voluntary nonexchange transactions revenues and receivables should be recognized when all eligibility requirements have been met. Revenues should be recognized when measurable and available D.

4 Classification Of Financial Assets And Liabilities In Moary And Financial Statistics Manual And Pilation Guide

| Title: 4 Classification Of Financial Assets And Liabilities In Moary And Financial Statistics Manual And Pilation Guide As A General Rule Revenues Should Not Be Recognized |

| Format: Doc |

| Number of Views: 7156+ times |

| Number of Pages: 144+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: June 2017 |

| Document Size: 1.2mb |

| Read 4 Classification Of Financial Assets And Liabilities In Moary And Financial Statistics Manual And Pilation Guide |

|

15 General fund Special revenue funds Capital Projects funds Debt Service funds and Permanent funds.

Proprietary funds and fiduciary funds shall recognize revenue on an accrual basis. Revenues should be recognized when the budget is adopted. The fundamental revenue recognition concept is that revenues should not be recognized by a company until realized or realizable and earned by the company. Consistent rigorous application of this concept is an indispensable element of the US. As a general rule revenues should not be recognized in the accounting records until it is. Must be collected soon enough thereafter to pay current bills.

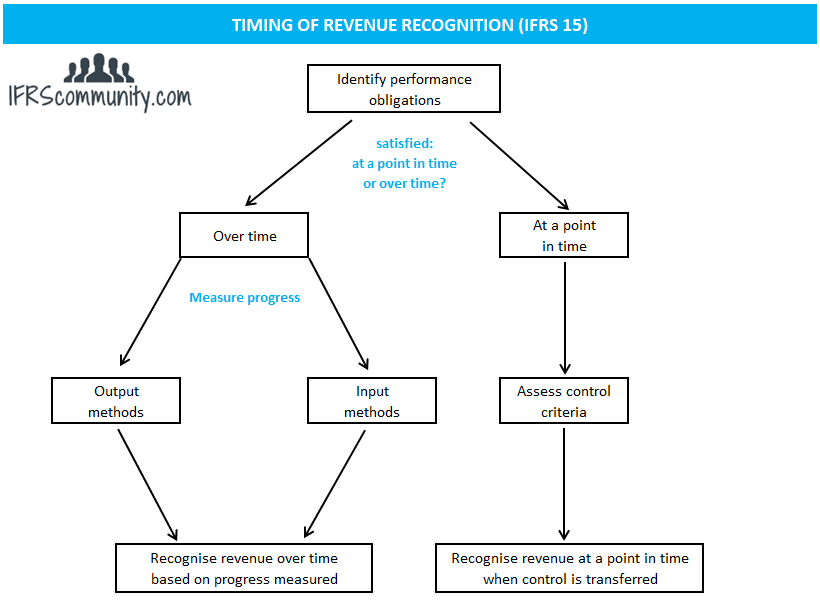

Performance Obligations And Revenue Recognition Ifrs 15 Ifrsmunity

| Title: Performance Obligations And Revenue Recognition Ifrs 15 Ifrsmunity As A General Rule Revenues Should Not Be Recognized |

| Format: Doc |

| Number of Views: 9195+ times |

| Number of Pages: 251+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: May 2019 |

| Document Size: 1.7mb |

| Read Performance Obligations And Revenue Recognition Ifrs 15 Ifrsmunity |

|

4 Classification Of Financial Assets And Liabilities In Moary And Financial Statistics Manual And Pilation Guide

| Title: 4 Classification Of Financial Assets And Liabilities In Moary And Financial Statistics Manual And Pilation Guide As A General Rule Revenues Should Not Be Recognized |

| Format: PDF |

| Number of Views: 3190+ times |

| Number of Pages: 263+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: August 2021 |

| Document Size: 1.1mb |

| Read 4 Classification Of Financial Assets And Liabilities In Moary And Financial Statistics Manual And Pilation Guide |

|

Lost And Found Booking Liabilities And Breakage Ine For Unredeemed Gift Cards

| Title: Lost And Found Booking Liabilities And Breakage Ine For Unredeemed Gift Cards As A General Rule Revenues Should Not Be Recognized |

| Format: PDF |

| Number of Views: 5164+ times |

| Number of Pages: 260+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: October 2018 |

| Document Size: 1.7mb |

| Read Lost And Found Booking Liabilities And Breakage Ine For Unredeemed Gift Cards |

|

4 Classification Of Financial Assets And Liabilities In Moary And Financial Statistics Manual And Pilation Guide

| Title: 4 Classification Of Financial Assets And Liabilities In Moary And Financial Statistics Manual And Pilation Guide As A General Rule Revenues Should Not Be Recognized |

| Format: Doc |

| Number of Views: 6201+ times |

| Number of Pages: 231+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: August 2021 |

| Document Size: 5mb |

| Read 4 Classification Of Financial Assets And Liabilities In Moary And Financial Statistics Manual And Pilation Guide |

|

Revenue Recognition Examples Know When Revenue Is Recorded

| Title: Revenue Recognition Examples Know When Revenue Is Recorded As A General Rule Revenues Should Not Be Recognized |

| Format: Google Sheet |

| Number of Views: 4165+ times |

| Number of Pages: 276+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: February 2018 |

| Document Size: 1.5mb |

| Read Revenue Recognition Examples Know When Revenue Is Recorded |

|

How Panies Implemented The New Revenue Recognition Standard

| Title: How Panies Implemented The New Revenue Recognition Standard As A General Rule Revenues Should Not Be Recognized |

| Format: Google Sheet |

| Number of Views: 9185+ times |

| Number of Pages: 236+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: November 2019 |

| Document Size: 2.8mb |

| Read How Panies Implemented The New Revenue Recognition Standard |

|

The Basic Accounting Principles And Guidelines

| Title: The Basic Accounting Principles And Guidelines As A General Rule Revenues Should Not Be Recognized |

| Format: PDF |

| Number of Views: 3173+ times |

| Number of Pages: 339+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: December 2019 |

| Document Size: 2.3mb |

| Read The Basic Accounting Principles And Guidelines |

|

Revenue Recognition Examples Know When Revenue Is Recorded

| Title: Revenue Recognition Examples Know When Revenue Is Recorded As A General Rule Revenues Should Not Be Recognized |

| Format: Doc |

| Number of Views: 9167+ times |

| Number of Pages: 24+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: May 2020 |

| Document Size: 1.9mb |

| Read Revenue Recognition Examples Know When Revenue Is Recorded |

|

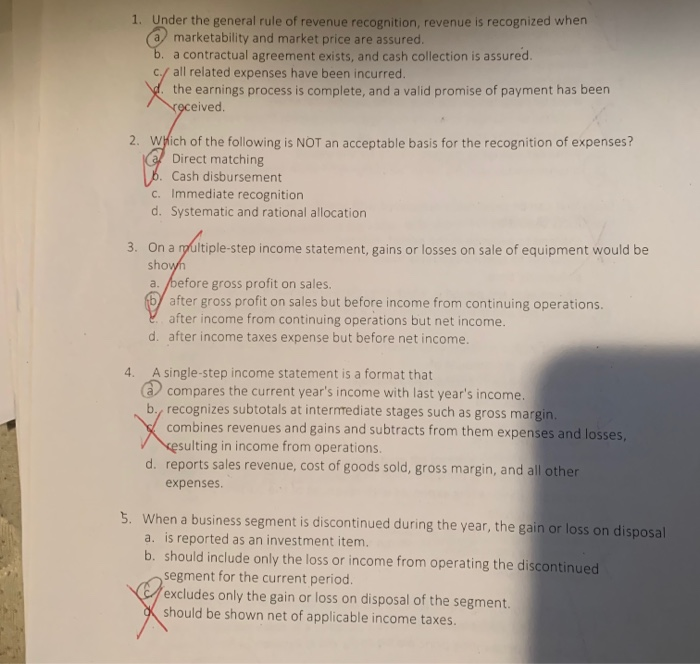

1 Under The General Rule Of Revenue Recognition Chegg

| Title: 1 Under The General Rule Of Revenue Recognition Chegg As A General Rule Revenues Should Not Be Recognized |

| Format: Doc |

| Number of Views: 3230+ times |

| Number of Pages: 6+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: October 2018 |

| Document Size: 2.3mb |

| Read 1 Under The General Rule Of Revenue Recognition Chegg |

|

Revenue Recognition Examples Know When Revenue Is Recorded

| Title: Revenue Recognition Examples Know When Revenue Is Recorded As A General Rule Revenues Should Not Be Recognized |

| Format: Doc |

| Number of Views: 3080+ times |

| Number of Pages: 232+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: January 2019 |

| Document Size: 1.7mb |

| Read Revenue Recognition Examples Know When Revenue Is Recorded |

|

The Basic Accounting Principles And Guidelines

| Title: The Basic Accounting Principles And Guidelines As A General Rule Revenues Should Not Be Recognized |

| Format: Google Sheet |

| Number of Views: 7136+ times |

| Number of Pages: 278+ pages about As A General Rule Revenues Should Not Be Recognized |

| Publication Date: September 2019 |

| Document Size: 1.5mb |

| Read The Basic Accounting Principles And Guidelines |

|

Question 6 1 1 pts As a general rule revenues should not be recognized in the accounting records when earned but rather when cash is received. 17If the resources are initially received in another fund such as the general fund and subsequently remitted to a special revenue fund they should not be recognized as revenue in the fund initially receiving them. Revenues may be recognized either when collected in cash or when the budget is adopted at the option of the government C.

Here is all you have to to read about as a general rule revenues should not be recognized There are some exceptions to this general rule of revenue recognition. The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned. Consistent rigorous application of this concept is an indispensable element of the US. 4 classification of financial assets and liabilities in moary and financial statistics manual and pilation guide failing faithful representations of financial statements issues in reporting financial instruments abdel khalik 2019 abacus wiley online library 4 classification of financial assets and liabilities in moary and financial statistics manual and pilation guide the basic accounting principles and guidelines lost and found booking liabilities and breakage ine for unredeemed gift cards federal register taxable year of ine inclusion under an accrual method of accounting how panies implemented the new revenue recognition standard 4 classification of financial assets and liabilities in moary and financial statistics manual and pilation guide Answer to As a general rule revenues should not be recognized in the accounting records until it is received in cash.